You may have seen the story in the local news last week of a person being scammed out of £70,000.

Fortunately, the victim has since been reunited with their savings. But these types of crimes are becoming more commonplace, and the move to online, rather than face to face during the current pandemic is creating more and more opportunities for scammers.

We may think that it won’t happen to us or that we’re too smart to fall for a scam, but we all need to be on guard.

It would be understandable for our minds to not be entirely on the ball right now, especially following the recent community Covid cases and the introduction of the circuit breaker lockdown.

Here are six points to help keep you safe:

1 – Use strong passwords

Nearly everything requires a password. As time has gone on, passwords have needed to be more sophisticated to meet security criteria.

But are your passwords strong enough?

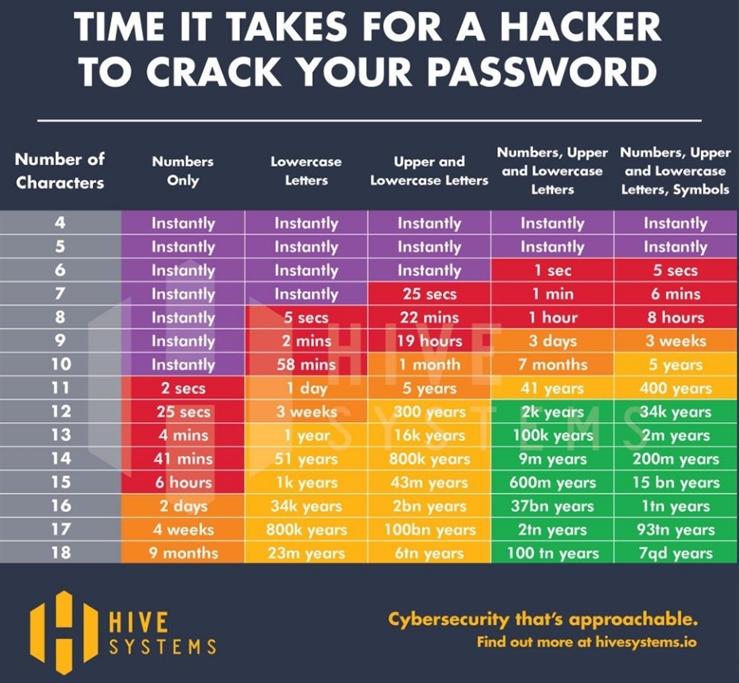

The below from Hive Systems shows how long it takes a hacker to hack into your accounts potentially.

If you fall somewhere in the last column, make sure you’re not guilty of using an obvious, secure password.

If you have 7 minutes spare, watch this clip from Michael McIntyre: Password sketch

If it sounds scarily familiar, it might be time for an update!

2 – Be email alert

We may no longer be fooled by emails from those claiming to be royalty or lottery winners with millions of dollars ready to transfer as soon as we send our bank details. Still, email scams are becoming more sophisticated, and it can be easy to get caught out.

In just the last two weeks, I have received emails from Amazon, PayPal and TV Licensing looking for login or payment details. Of course, none of these was genuine.

Some of these phishing emails are blatantly fake. They are often full of typos or sent from an unusual email address, not in keeping with the company name.

Some, however, can be pretty convincing.

Remember not to follow links in emails. If you are concerned about a recent transaction, log in to your account via the official website.

Do your bit to protect others by forwarding any suspicious emails to SERS@OCSIA.IM the Island’s suspicious email reporting service.

3 – Use secure portals

Emails can also be intercepted. It would help if you thought of an email as a postcard – anyone can read it along the way.

If you include personal data in your emails, you are potentially giving cybercriminals all the data they need to steal from you or clone your identity.

For this reason, we introduced “Doc Safe” – our secure client portal. We take confidence that clients’ personal and financial data is communicated securely via our portal.

You should think twice before sending information via email. What if this information ‘postcard’ was read along the way?

4 – Vet your phone calls

I started this article referencing a recent scam case. This story came about after the victim took a call supposedly from Amazon regarding a recent transaction.

We are currently more reliant on online shopping than ever, and scammers know that.

Never give details over the phone. If you are unsure, hang up and call the company on the official, published contact number.

One of the benefits of using a financial planner is that we can be the contact for your financial providers.

5 – If it sounds to go to be true, it probably is

A very simple statement but one that is true; we say it time and time again – there is no such thing as a get rich quick scheme.

If you think about it logically, if there were, we’d all be rich by now!

The FCA reported 30,000 cases of unregulated activity in the past 12 months with 10,000 investment fraud cases. A significant number of these cases are linked to pension funds; pension funds that have been built up of hard-earned money over a whole working lifetime.

Using a regulated Financial Planner and regulated pension and investment products gives you added protection.

As financial planners, we have the expertise to know what works – what will help you achieve the future you want. There are no shortcuts.

Please take a look at our regulator’s guide to spotting a scam: How to spot a scam

6 – Be wary of social media and celebrity endorsements

In just four months during the UK’s initial lockdown, over 300,000 weblinks were taken down by the National Cyber Security Centre. These were all linked to fake celebrity-endorsed investment schemes.

Martin Lewis and Sir Richard Branson were just two of the names used by investment scammers.

Social media is useful for companies to engage with their clients, but be sure to visit their official website and do your research before making any financial decisions.

Keeping the above in mind will reduce your chances of falling victim to scammers. Be alert!