If some of these thoughts have been running through your mind during the recent stock market falls, it is perfectly understandable, and I hope this helps:

1 – What does this mean for my investment portfolio?

After seeing solid returns from investments in 2021, it can be not easy to handle seeing things take a turn the other way. It’s essential to remember that most investment portfolios aren’t exposed to the full extremes of stock market downturns.

It’s also worth a reminder of what the stock market is:

-companies

-managed by brilliant people

-pursuing rational business objectives

-measured by the value of earnings and cash flows.

Therefore, the stock market is a collection of the greatest companies in the world. Our client portfolios generally contain a blend of these “stocks” and less volatile assets such as government bonds, which aim to cushion the full extent of stock market falls when they come along.

You, therefore, own a part of the stock market within your portfolio. The proportion that this “part” amounts to for you depends on your attitude to risk and your goals. Our planning for clients is about finding the right balance between downside protection and potential long-term growth.

2 – Markets have fallen recently – when will they recover?

I would love to know and tell you exactly when, but I can’t.

Nobody can predict short term stock market movements, as they are based mainly on unpredictable events.

What we do know is that after the stock market falls over the last 100 + years, in the long term, the markets as a whole have recovered and prospered. This lesson from history is the key; we need to look to the long term; there are no shortcuts with investing.

3 – Is selling everything down into cash a viable option when markets get scary?

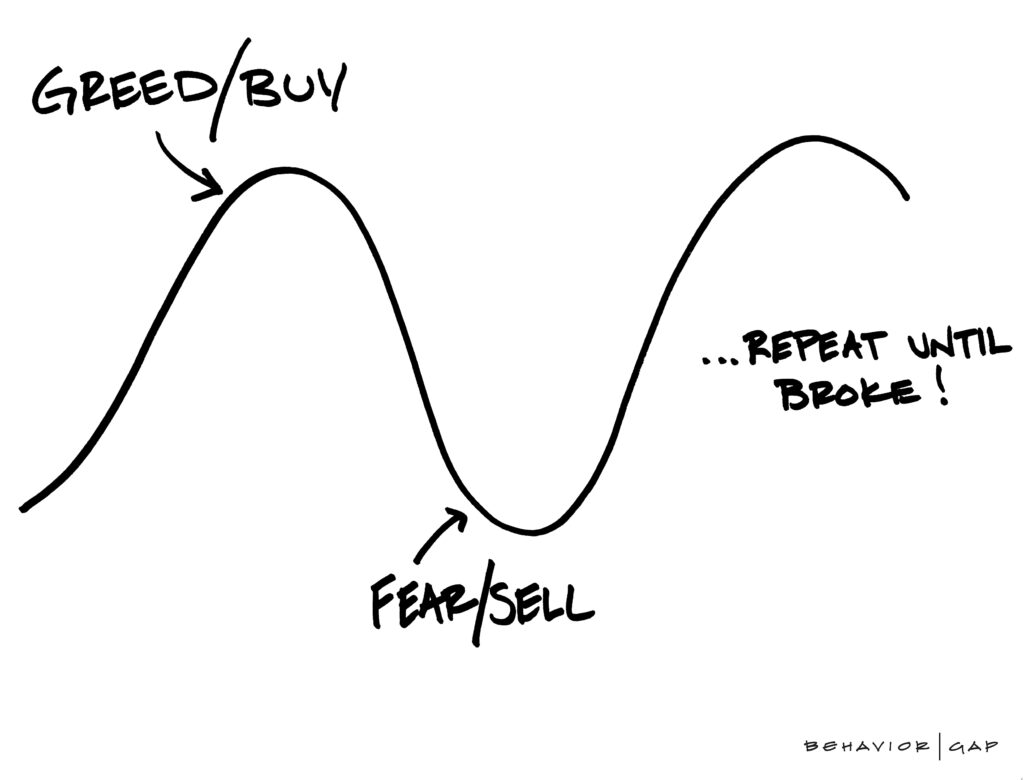

We sometimes get asked whether to sell everything down to cash when things get ugly and then buy back in when things appear a little calmer. This strategy sounds entirely sensible, at least in theory.

But, in reality, it’s impossible to do. You would have to get two calls consistently right.

The first call is getting out at the right time – the second is getting back in at the right time. Unfortunately, no green light flashes for the precise time you should do this!

And you need to do this every time there’s a sign of trouble in the world. Trouble never has been and never will be hard to find in the world.

We believe that this is a pretty sure-fire way to destroy your wealth over time, regardless of how comforting such a strategy may appear during times such as these.

4 – Is there anything I should do or change?

Our advice to our clients is to:

tune out the “noise” in the financial press and keep as calm as you can

remind yourself that sensible investing is a long-term thing, which has been proven to work with patience, discipline and by sticking to a plan

also, you will have been advised by us to keep a strong cash buffer based on your lifestyle expenditure and our agreed cashflow forecast for times like this when storms need to be weathered

Remember that, as a Thornton client, you have a well-diversified portfolio, with your eggs in hundreds of different baskets – and as I said before, you hold “part” of the stock market in your portfolio.

As Sharon commented in her article last week, please don’t be surprised right now if we tell you “to do nothing”.

At times of crisis, we’re generally wired to want to change things, to react, to make us feel that we are being proactive and “dealing” with the situation.

But unless your personal circumstances have fundamentally changed, keeping calm and doing nothing is almost certain to be our advice right now to you to keep you on the right path.

I hope this has helped. If you’ve got any concerns or questions about anything, we’re here for you – get in touch today.