I received an email last week that opened with the fact that we are now more than 10% through 2021.

I didn’t really appreciate the reminder that time is going far too fast, but at the same time, it did make me start to write this short article that, ironically, I have been putting off for the last week or two!

When you start work and earning your own money, it is one of the best feelings. Independence!

If you’re anything like me, the early years included buying things you didn’t need and focusing solely on getting from payday to payday.

At some point though, you realise that you really should start thinking about the future and the earlier you have this epiphany, the better, trust me!

Doing my job as a Chartered Financial Planner, I can sometimes take for granted my understanding of some of the most important financial lessons and messages. Things like inflation eroding the spending power of cash savings, the tax efficiency of pensions and perspective around investment risk and short-term volatility.

The one that always makes me smile is compound interest or returns. Allegedly described by Albert Einstein as the eighth wonder of the world, the results are pretty impressive.

Starting Young

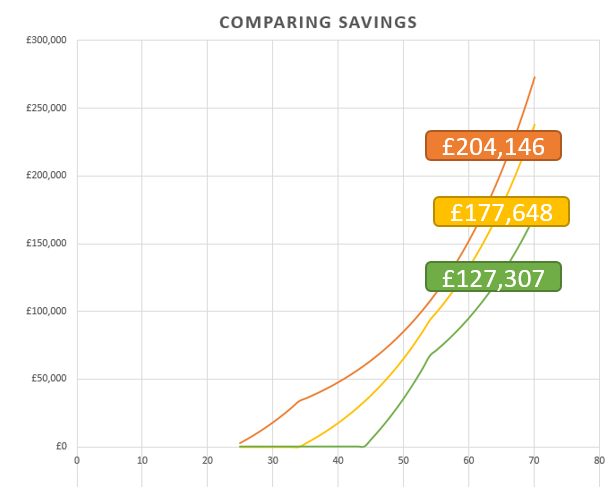

To illustrate my point, I have compared three savers/investors and assumed a 6% annual return rate.

In orange, we have a 25-year-old saving £2,400 per year for ten years. A total of £24,000 invested.

In yellow, we have a 35-year-old saving £2,400 per year for 20 years. A total of £48,000 invested.

In green, we have a 45-year-old saving £4,800 per year for ten years. A total of £48,000 invested.

The values shown are at age 65.

By starting ten years earlier, our 25-year-old saver has the largest retirement pot come age 65.

This result is impressive when you consider that, in total, they have contributed/invested half as much as our 35- and 45-year-old.

In fact, our 45-year-old has had to contribute twice as much per year as the 25-year-old to be left with a pot not much more than half the size.

The additional annual expense also limits their discretionary spending in these years, often the years where things like holidays and socialising are high on the agenda.

There are many ways to fund your retirement.

Some people have access to occupational pensions through their employers. Some have personal pensions.

Some have neither, instead opting to save/invest for retirement outside of a pension product.

Regardless of where you save for retirement, the message remains the same, start early!

Next steps

Contact us to find out more about financial planning and our pension and regular investment solutions.