Fear of the unknown is a natural human instinct. It is natural to feel scared of things that could potentially harm us.

However, when it comes to money, we do not necessarily need to feel anxious.

While we may not know when a significant financial crisis will hit or its cause, we do know it will happen eventually.

To alleviate anxious feelings, it is important to have a plan that considers the inevitability of unexpected changes and financial crises.

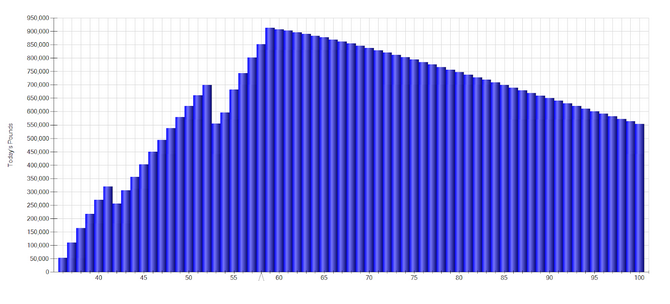

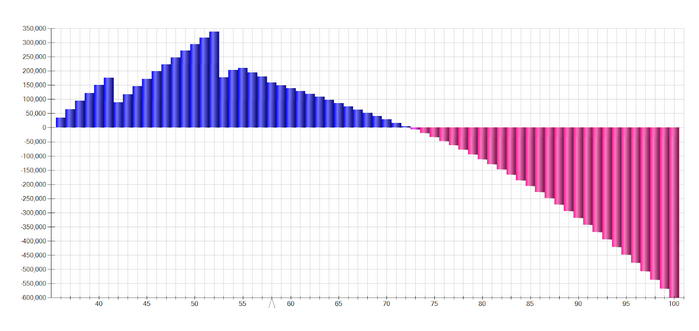

Having an image of what the future may look like based on average, best, and worst-case scenarios can go a long way in providing peace of mind.

While most people have not engaged the services of a regulated financial adviser, those that have may have only received transactional advice for a particular issue. Chartered Financial Planners like us provide much more in the way of personal context and forward-looking financial planning.

At Thornton, we spend most of our time creating, reviewing, and amending financial plans for our clients. However, many people are unaware of the peace of mind and clarity that comes from having a plan in place.

Our new clients tend to arrive with similar financial situations, with one or two pensions, savings, rental properties, and possibly a mortgage or a business. They may or may not have a good grasp of their expenditure and spending habits.

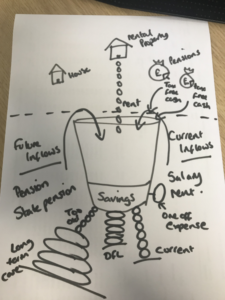

At Thornton, we turn this information into a picture – a picture of a bucket!

This bucket represents a simple way of consolidating liquid (inside the bucket) and illiquid (outside the bucket) assets.

We can then analyse your income and expenditure (taps) and make informed assumptions based on your lifestyle, goals, hopes, and aspirations. This allows us to see if your bucket overflows or runs dry and if the hole in the bottom is too big or not big enough.

A Thornton Financial Plan is about turning this bucket into a reality. We can look to the future and see how your bucket is looking.

Are you likely to reach the end of your life with an overflowing bucket? With our forward-looking financial planning, we can help you answer that question and ensure you have a plan to achieve your financial goals.