Are you making any of these financial mistakes in retirement?

Last week, I shared five common mistakes in part one of this blog post.

In part two, here are five more frequently made financial mistakes we see people make in the retirement.

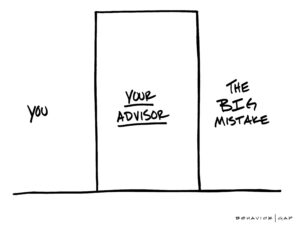

As Chartered Financial Planners, we help people to make sensible decisions about their money and how to live their best life possible with it.

This work means helping our clients to avoid making potentially costly mistakes.

Don’t fall into any of the following retirement traps:

6 – Not spending enough!

We don’t want people to make the mistake of having the money, but not the time to do things they’ have always wanted to.

We don’t know for sure how long we will live but we do know that life is not a rehearsal.

Life is all about getting the right balance of living today and preparing for tomorrow, which ongoing financial planning can help with.

7 – Helping family

We all want to help our family. But people can often underestimate their life expectancy and therefore how much they may need themselves.

This life expectancy calculator is worth a look, the results may surprise you! https://www.direct.aviva.co.uk/myfuture/LifeExpectancy/AboutYou

Our first duty is to make sure as best as we can that clients will not run out of money in their lifetime.

The flip side of the coin is having “enough” money and not realising it. This can stop people making gifts to family members who would really benefit from it.

This can be an emotive area. We can help talk this through and ‘do the numbers’ to clearly show what is and isn’t possible.

8 – Downsizing

Downsizing is another difficult one.

For many, their home will be their biggest financial asset.

Planning to unlock equity in retirement, when the kids have flown the nest, can make good financial sense. However:

-Don’t underestimate the emotional difficulty in leaving your family home. When the time comes, will you be able to leave behind the memories?

-Don’t overestimate how much equity you may unlock. Our homes are just houses to new buyers, and what they’re willing to pay maybe less than you hoped.

Getting the timing right is hard. Very few manage to make the move just before they need to, but it is far better to ‘prepare than repair’.

9 – Not having a Will and Enduring Power of Attorney in place

I’ve never spoken to anyone who wants to leave a mess for their family to deal with. But this is what can happen if you haven’t made a Will.

And it’s what happens if an Enduring Power of Attorney hasn’t been put in place and someone loses mental capacity, no longer capable of making their own financial decisions.

Your family will be grateful if you avoid making this mistake.

10 – Over complicated finances

I often say to people that there are no medals awarded for overcomplicating investments and financial plans.

Unnecessary complexity bamboozles people and results in extra cost.

We think it is a mistake to over complicate. Even if you have a handle on your current complex arrangements, does your spouse? How will they cope?

Do any of these financial mistakes to avoid in retirement resonate with you?

Here at Thornton, we exist to inspire you, give you confidence and the freedom to live the best possible life with your money.

If that sounds like a worthwhile outcome, please get in touch – we would love to hear from you.