Boris Johnson. Liz Truss. Rishi Sunak. Three UK Prime Ministers in three months, and the strong possibility of a Sir Keir Starmer-led Labour government at the next election.

Add to this the succession to the throne of King Charles last September, and there’s been more than enough change for anyone’s liking.

While this may cause concern for those who would prefer their ruling party to be a beacon of stability in an otherwise uncertain world, it may not have the financial consequences some are concerned about.

Should you be making portfolio changes in light of these transitions? In short, almost certainly not.

We believe this is just the latest episode in a litany of events tempting you to do something when the correct answer for most people is to do nothing.

What You Should Know

Politics today may be as divisive as it’s been in many decades.

The world’s dominant power is gearing up for its elections. China’s power struggles continued in the Communist Party National Congress. Russia and Ukraine are sadly still at loggerheads.

What lies ahead for the governing class of these nations, and how will this affect global financial markets? In short, no one knows.

While we have clarity about what moves markets in the long term, its short-term vagaries are determined by the madness of crowds. We cannot confidently incorporate this into a financial plan or investment policy.

Any attempt to profit off potential short-term reactions to these political events is merely market timing in disguise. Those attempting this risky endeavour are not investing but speculating on an unknown outcome.

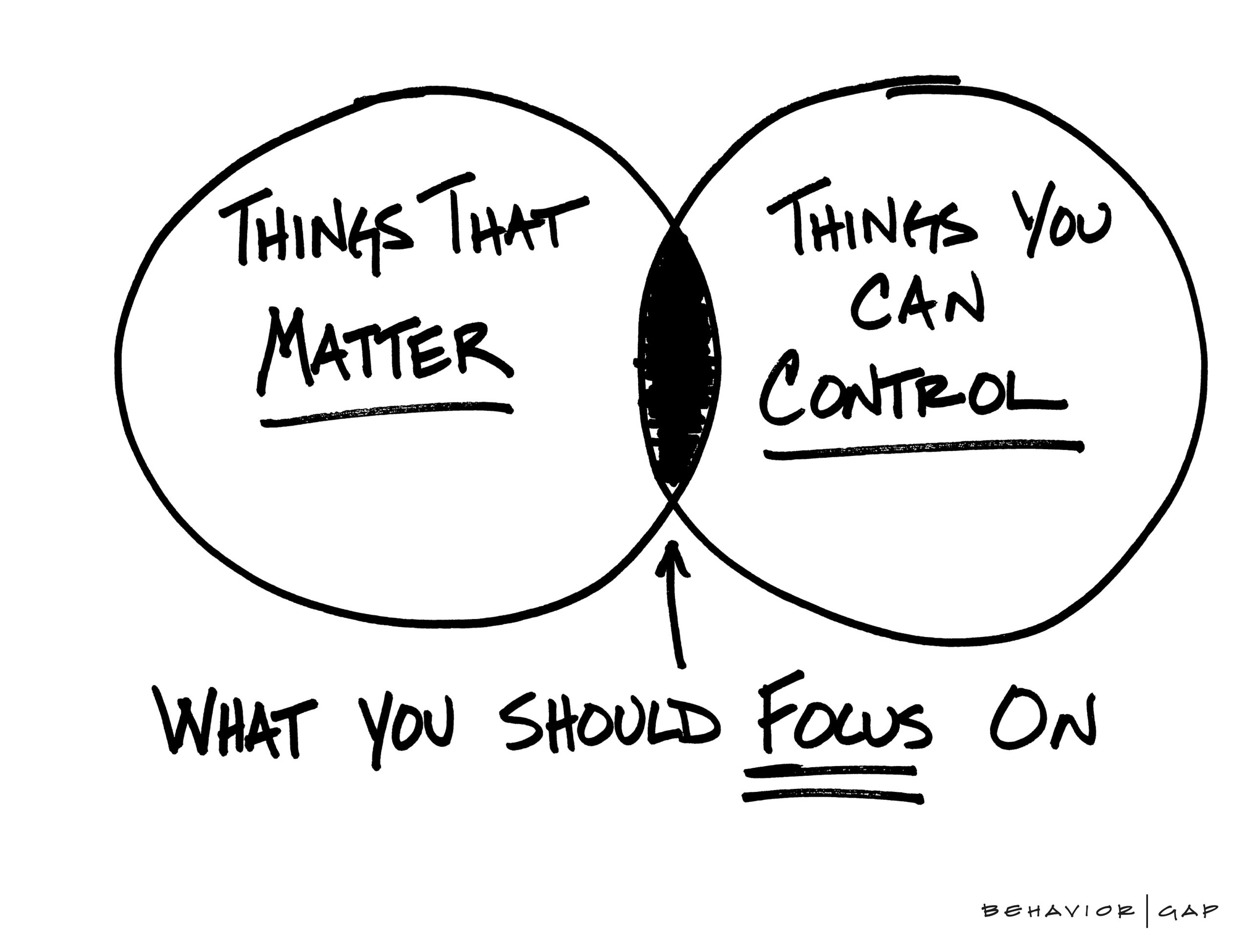

Real investors focus on the long term, clear about what they can control and can’t.

While we know very little about the short term, we know much more about the long term.

We know that businesses and those who manage them adjust remarkably well to the changing landscapes in which they operate. In remaining focused on the demands of consumers, they find ways of innovating regardless of who the sitting government happens to be.

If, as a group, these businesses continue to grow their earnings and dividends, we, as disciplined and patient investors, will benefit.

The dominant force which propels our world forward is technology. Technological advancements have had a much more meaningful impact on shaping this world than the battle flag of the party in power.

These technological advancements manifest as companies we are all invested in, whether through their shares as part of portfolios or through our consumer spending.

What You Should Do

While politics is important, and many people admirably get involved in improving the lives of those around them, it’s also a very emotional subject.

One thing we know about investing and money generally is that it doesn’t mix well with emotions. Frankly, it’s a recipe for disaster. For this reason, a good rule of thumb is never to mix your politics with your money.

If your goals haven’t changed, and you’re already invested in the appropriate portfolio, it’s likely safe to do nothing. Focus on the things you can control: your saving rate, spending rate, and asset allocation.

Rather than getting involved in politics, enjoy the run-up to the end-of-the-year festive period with your loved ones.

Rishi Sunak will not be the last UK Prime Minister, and there will be many more US elections beyond November 2024. No doubt by then, we’ll all be incredulous and bored in equal measure.

No matter how passionate you are about government actions, we recommend you not bet your financial future on what this means for financial markets.