There’s just so much going on at the moment that is entirely out of our control; a war, a pandemic, and financial markets are particularly volatile.

Interest rates and price inflation are both on the move for the first time in a while, leading to the current ‘cost of living crisis’.

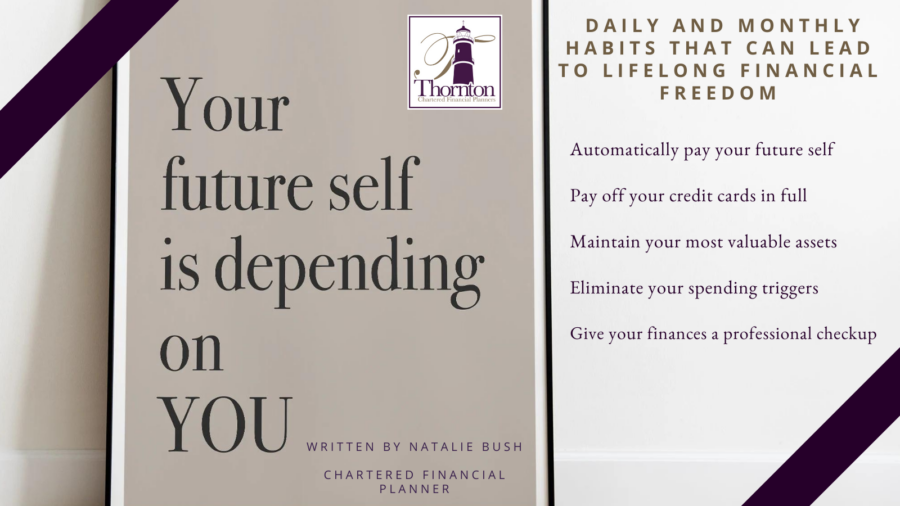

At times like this, though, we need to remind ourselves to control the controllable. We can’t fix any of the above, but we can implement good habits that, regardless of what’s going on in the world, will help us achieve financial freedom in the future.

These five simple daily habits really can help; give them a try!

1. Automatically pay your future self.

Adding monthly saving and investment goals to your household budget is an excellent way to ensure you’re dedicating a part of every paycheck to your future. But many people tend to dip into these future funds for short-term expenses because they know that money is available.

After all, you don’t need to retire tomorrow, so why not have a few extra takeaway meals this month or buy a new TV you don’t really need?

Pay your future self first by automatically deducting contributions every month to set those saving and investing budget items in stone. By committing to those investments in your future, you’ll also be committing to the rest of your budget.

2. Pay off your credit cards in full.

In some financial planning discussions, credit cards get a bad rep. But there’s nothing wrong with using credit cards – or even multiple credit cards – as long as you use them responsibly.

And the most responsible way to use credit cards is to pay them off completely, either right after a big purchase or at the end of every month. Other debt items on your monthly budget, like student loans, car payments, or mortgage, typically have much lower interest rates. Paying off high-interest credit cards in full and on time will keep your spending under control and improve your credit rating.

If you find yourself struggling to stay on top of your credit card bills, switching more of your spending to cash might be a good idea. Using a debit card or a payment service like PayPal, that’s tied to your bank account can help you be more mindful about what you’re about to buy and how you will pay for it.

3. Maintain your most valuable assets.

Try as you might, you can’t wish away the warning light on your dashboard. Eventually, that spot on your roof that only leaks when it’s raining hard will run like a tap any time there’s a sprinkle. Take care of minor problems when they’re still small, and you’ll avoid paying more significant bills later.

4. Eliminate your spending triggers.

We often don’t think to consult our household budgets when there’s a sale at our favourite shop or when a daily deal bouncing around our social media feed looks too good to pass up.

If you find yourself susceptible to splurge purchases, think about ways you can reduce spending opportunities. Turn off ad notifications from shopping apps. Unsubscribe from magazines or email newsletters that make you want to buy more stuff. Keep your wallet or purse out of reach. The long walk up that flight of stairs might be enough to deter you from a purchase you will regret when your next credit card statement shows up.

5. Give your finances a professional check-up.

Is a big promotion about to change your financial goals?

Does your elderly mother need to adjust her living situation?

Is work a pain and retirement on your mind?

Whenever your life and your money are about to turn a corner, talk to a professional who can help you sort through your options. We certainly want to be on that speed dial, so if you need to discuss long-term goals, short-term concerns, or anything in between, don’t hesitate to get in touch.