Back in 2008, when the global financial crisis was in full swing, I was blissfully unaware of the ensuing chaos in the finance sector.

I was still working in retail, and as a result of the long and often unsociable hours, the majority of the people I knew were in the same industry.

Us retailers were as busy as ever, and life went on.

Fast forward to now, and my situation is very different. The economic downturn caused by the Covid-19 pandemic is very much front and centre of my mind and affecting the people around me.

A number of my friends have been made redundant in the last six months and what has been surprising is the number of different industries and sectors affected.

Another surprising discovery is how resilient and optimistic most people are. The old saying – “one door closes, another opens” has been muttered on more than one occasion and often, with the benefit of hindsight, redundancy can be the change/shove that was always needed to do something different/new.

That being said, the uncertainty of the situation in the here and now can quickly cause worry and sleepless nights. This is why I think the use of Financial Planning, using cash flow analysis software, can help in seeing a future post-redundancy.

Putting you back in control of your ‘new future’ may be just what you need.

1 – Compare redundancy offers/packages.

Sometimes redundancy packages are set, but often there can be several offers on the table. Options can include more considerable lump sums and discounted pensions, smaller lump sums and larger pensions, payment instead of notice etc.

When these are paragraphs in a letter, it’s almost impossible to picture how these offers play out over time.

The urge can be to take the larger initial sum but is this the best thing to do? The answer largely depends on what you think your future looks like.

Do you have debts to clear, do you plan to have an active early retirement, do you have other income sources due to kick in, in future, and only need cash now to bridge the gap?

Using cash flow analysis, we can sit with you and compare options. You can see the outcomes for yourself. With all the potential answers in your possession, you’re empowered to chose the option that’s right for you.

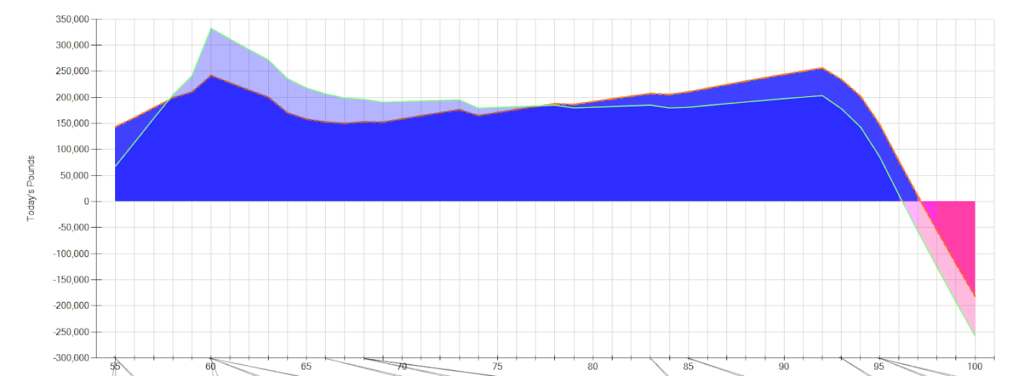

Fig 1. Two offers overlayed and projected to age 100.

2 – Determine whether you need to work. Is early retirement or a sabbatical an option?

Depending on your age, or the length of your career, you may be considering early retirement.

Maybe your redundancy payment is enough that you don’t need to work again, perhaps you’re not quite there yet.

Travel probably isn’t going to be the top of to-do lists right now, but in the future, maybe a sabbatical is an option freeing you up to tick other items off the bucket list. Spend more time with family etc.

We can go through several scenarios with you, looking at your other income sources, turning off certain income, building in future income and at different rates – full-time or part-time, for example.

We can also price your retirement lifestyle. Will you eat out more often, spend more on utilities, less on commuting/parking etc?

3 – Identify your future salary requirements/ Can you retrain in a new field?

If retirement is not achievable just yet, or if you’re not ready to stop working, we can help you establish your minimum salary requirements.

By costing your future, we can identify how much you would need to earn each year for the remainder of your working life to fund it. If this is less than your current income, you might want to think about reducing your hours.

Alternatively, you may be tempted by a change of career path.

Trainee positions usually come with lower salaries, and the thought of this may have previously put you off.

With a redundancy payment providing a cash buffer, maybe now is the time to consider training in another field, or investing in your development through the UCIOM, for example.

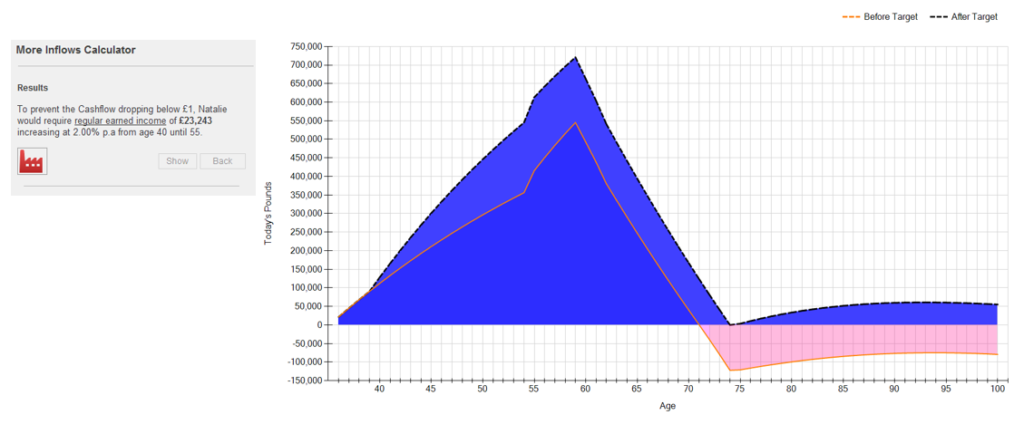

Fig 2. Identifying the minimum salary required until retirement.

4 – Help establish new spending budgets

If you know that stopping work isn’t an option and you have a relatively clear idea of the salary you will achieve in your next role, maybe it’s the other half of the calculation you need clarity of– the outgoings.

Some people have a good grasp of their essential living costs, such as utilities. Some even have a good idea of what they spend on hobbies and holidays.

In my experience, few have a good handle on discretionary spends/incidentals.

Put it this way – do you ever have as much left the day before payday as your figures would suggest on paper!? I know, I don’t.

Having a budget helps you take control of your spending and reduces the chance of frittering money away on unnecessary purchases. Cash flow can help identify how much you have left after essential expenditure.

It’s then entirely up to you how you split this into individual budgets to have available for what’s important to you.

A big part of planning is about giving ‘permission to spend’ – enjoying your money whilst staying within your means.

5 – Do you need to review your pension options? Or look at replacing other employer-offered benefits?

Maybe you were a member of your employer’s occupational pension scheme or a group personal pension.

Are you able to continue to make contributions? Do you require a new pension vehicle to pay into? Maybe your new employer doesn’t offer a scheme for the first year or two, and you want to look at personal pension planning.

If your retirement age has changed, maybe your investment strategy needs to change. There are so many other questions relating to pensions, but the answers will always depend on what your future plans look like.

You need a proposed goal before you can determine if what you already have are the best tools to get you there.

Also, there may be other employer benefits that you need to review or replace.

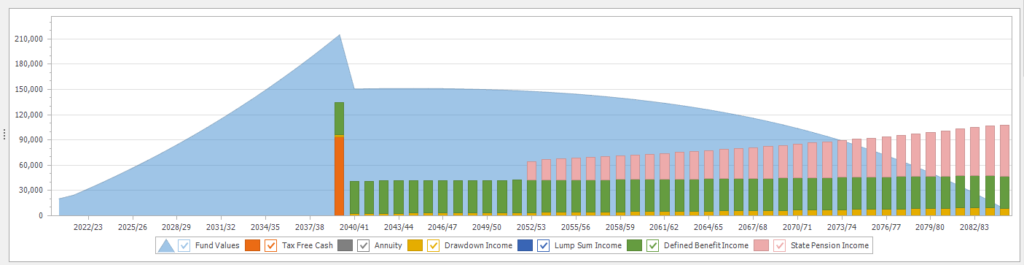

Fig 3. A pictorial overview of the interaction of a client’s various pension sources.

Positive changes

Knowledge is power.

Having a clear picture of where you want to be and where you’re potentially heading helps you make decisions now that will affect your future.

Goals change, plans don’t go to plan and life is bound to throw a curveball or two along the way. BUT having a plan, a version of the future to aim for, can only help in reducing anxiety and paving the way to the future you want.

We can build a financial plan with you to help answer your questions.

Cash flow planning with Thornton Chartered Financial Planners starts from £1,750, which is a small price to pay for your financial peace of mind.

Get in touch by emailing us at mail@thorntonfs.com or calling 01624 660220 to arrange an initial chat, so we can help you find the balance between today and tomorrow.