Russia’s invasion of Ukraine is shocking and sad.

The eventual attack on its neighbour has shaken core beliefs around peace and security in Europe.

Our thoughts are with the people of Ukraine who risk losing both their country and their liberty.

Of course, the real cost of the invasion will be the thousands of people, both armed forces and civilians, who lose their lives to satisfy Putin’s desire to remake the world according to his own belief system.

Russia is famous for its high spending oligarchs, with expensive property portfolios and glitzy lifestyles, but this masks the truth. Russia is fundamentally a poor country.

The far-reaching sanctions will hit the citizens of Russia hard, and the majority, who want nothing other than peace, will be hit hardest. Our thoughts are also with all of those who will be affected by this unprovoked act of aggression.

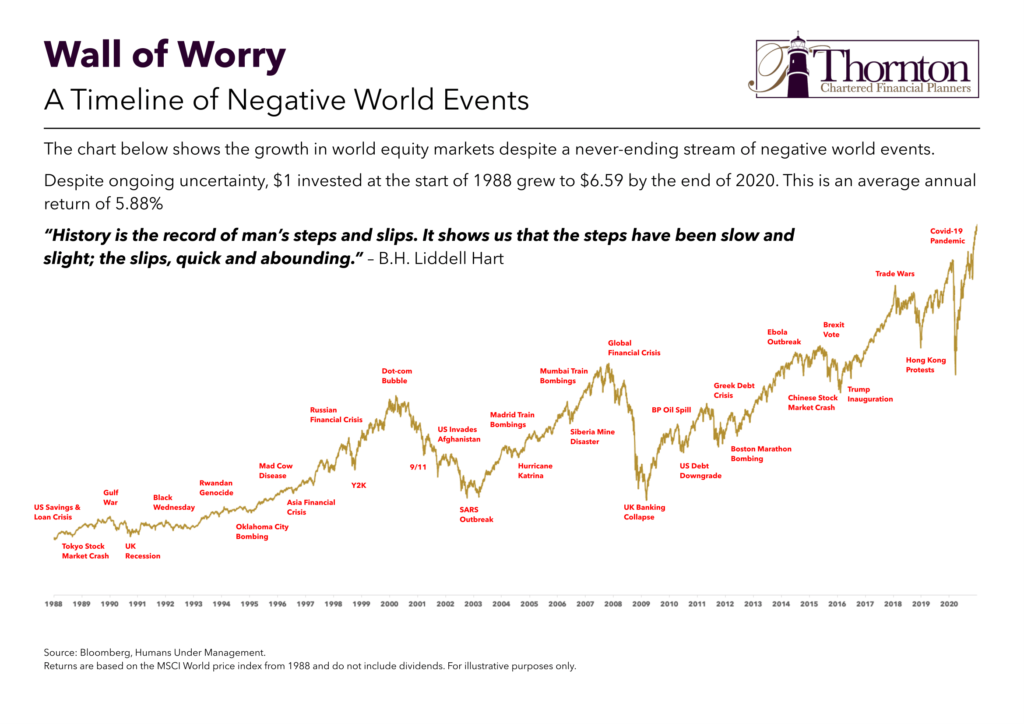

31 Crises and counting

Our careers as financial advisers will be measured by the number of crises we guide our clients through.

Since 1988 I have counted 31, not including this one.

For those children particularly of secondary school age, therefore, it is understandable they worry, having been through Covid.

My son Luke and I were talking about the situation in Ukraine; “You might think this as being your first global crisis” I said, “but as you’re 15, this is, by global stockmarket volatility standards, your 14th since 2008. I’ll let you off not remembering the ones before 2012 but you might remember the Hong Kong protests, the Ebola Outbreak, the Trump inauguration, Trade wars, Brexit and of course Covid? These 14 events have been responsible for media-fuelled negativity, and stock market falls, and for you all to worry greatly about our planet and its future (or whether you might ever get to go to Florida on holiday again!).”

Do nothing

Early in my career, I thought they’re all different, requiring an answer that will impress clients. However, there comes a day when you discover an important truth: they are all the same, and the message to you, dear client is very simple: do nothing.

Your portfolio was set up correctly on day one. My job is to ensure you stick with your historically appropriate, built with the future in mind, investment portfolio.

My intention is of course not to be seen as in any way condescending to you, but we are surrounded by many who have been programmed by the media to look for a sophisticated answer.

The fear you experience during uncertain times is natural. Indeed, we often feel it ourselves.

But we owe it to you and to ourselves and to our families not to pander to this fear and make mistakes which the market will expose in hindsight.

Advising you to change strategy temporarily might sound clever and justify our being, but it’s not our calling.

Thornton and our investment partners carefully and continuously monitor the current downside and we have parameters in place to monitor the safeguard of your assets in keeping with your individually assessed and agreed risk tolerance, including the use of lifelong cashflow modelling within your long-term plan.

I repeat, do nothing!

Needless to say, I will not be making any short-term changes to my family’s portfolio. Neither will we be choosing to facilitate such a change for any of our clients.

This is not a prediction for how the market will react in the next few days and weeks, because nobody knows this. I believe it’s the right course of action regardless of what unfolds.

History is the record of man’s steps and slips. It shows us that the steps have been slow and slight; the slips quick and abounding.

-BH Liddell Hart