If I had £1 for every person who’s asked me one of the following questions, I’d certainly have made a decent sum:

-Are markets at their lowest?

-Will markets start to pick up now?

-Will there be a further fall to come?

-How long will it take for markets to recover?

The simple answer is I don’t know, and the truth is that no one does.

Putting the important health and welfare issues of the coronavirus pandemic to one side, a much-discussed and debated issue right now is the economy and global financial markets. Everyone has a view!

Now working from home, I’ve incorporated a number of webinars in my working week. One I listened to on Thursday was particularly good and focused on similar, major past events.

Now when I say similar events, I don’t necessarily mean other global pandemics.

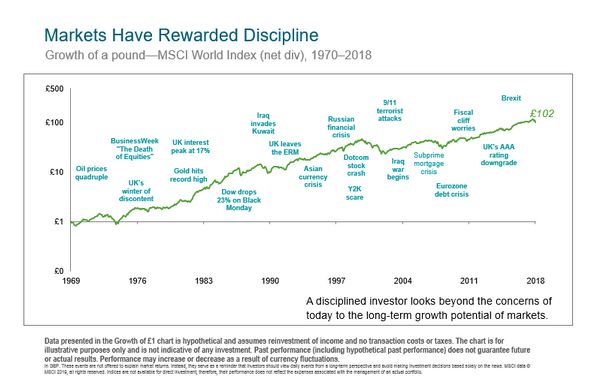

The point is that there are many, many national or global events that affect global financial markets. We probably all remember the financial crisis of 2008, maybe the “dot-com” bubble of 2000, and we’re all aware of the World Wars.

The causes may be different but, in every instance, humanity, the world and financial markets have recovered and thrived in the long term.

Take the £1 I wish I had for all those unanswerable questions, if that had been invested in world markets back in 1970 it could now be worth £102 even after these major events.

It’s likely that you already know all that, I mean why would people still invest in markets if there wasn’t money to be made.

What people outside of the profession perhaps don’t appreciate is the potential value of simply being invested.

It’s not about timing the markets, it’s time in the markets.

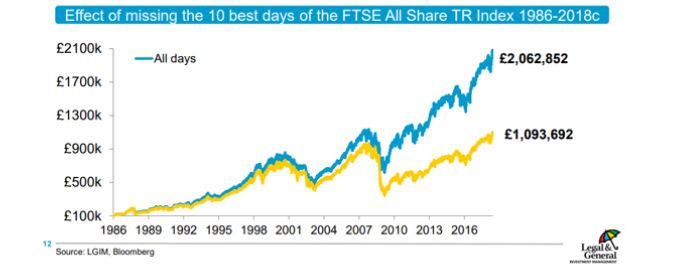

The potential cost of not being invested can be staggering.

Take the FTSE All Share from 1986 to 2018. Assume that you were not invested to benefit from the best 10 days of returns and you would almost halve your returns.

In reality, an investor would not miss the best 10 days only. If we could predict markets to that extent, we would be sure to avoid the worst 10 days which has a much greater impact on final returns.

It does, however, show the potential scale of the effect of missing opportunities.

Another thing to remember is that being invested for these early “best days” mean there is more invested to capture the benefits of the future “best days”, known as compounding.

Continued volatility over the coming months is a given. Markets move constantly based on many things including sentiment, how people react in the short term to events rather than how profitable/strong a company is and what its prospects are for the future.

But volatility is a normal part of investing. We know markets go up and down and can be a source of disappointment and anxiety during downturns but we certainly shouldn’t be surprised by them.

Anyone considering an investment at this time needs to appreciate the importance of having a sufficient cash reserve.

But with all known future expenses accounted for, you may have surplus monthly income available to work for you.

Inflation reduces the spending power of your cash. Investing for the long term can potentially achieve returns to negate the long term effect of inflation.

The ‘price’ we pay for these potential returns is some degree of volatility i.e. the value of your investment going up and down along the way. Guaranteed/risk free real returns simply don’t exist.

Regular investing can help investors benefit from falling and/or volatile markets. By investing at regular intervals more shares/units are purchased when prices are low and fewer are purchased when prices are high.

If you have:

-a desire for your cash to retain its spending power

-surplus monthly income of £300+

-an appetite to accept a certain level of investment risk

-a long-term investment objective (usually 10 years +)

then please do get in touch to discuss your options.