Anxiety is fear of the unknown. An impending sense of uncertainty, or a stress response to a perceived threat in the future. The brain and body are often caught up in sensations and feelings of tension, or a sense of apprehension that keeps the mind locked into a cycle of excessive worry, anticipation and panic.

(Greg Savva, Counselling Directory)

During the early stages of the Covid-19 pandemic, and indeed the early stages of lockdown, I felt anxious. I’m sure many did.

Fear of the unknown is natural. We need to be scared of things that potentially threaten us, but we don’t necessarily need to feel anxious about money.

None of us could have predicted the pandemic and fear of the potential health implications for ourselves and our families is/was expected and understandable.

From a financial perspective, we might not know the cause, or when a significant financial crisis will hit, but we do know that one will.

Covid-19 was not the first, nor will it be the last, a point discussed in my previous article.

Having a plan that factors in the inevitable provides peace of mind.

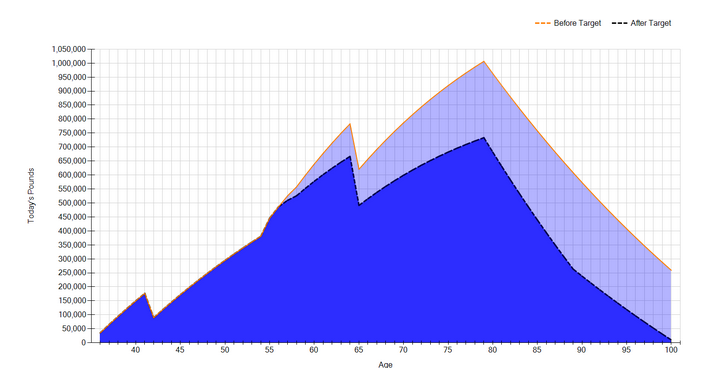

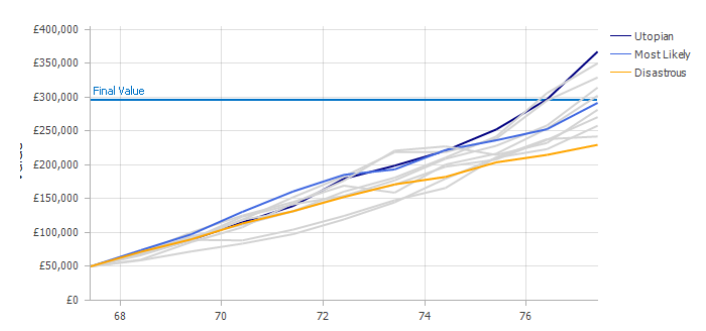

Having an image of what the future might look like based on average, best, and worst-case scenarios can go a long way to relieve anxious feelings.

The vast majority of people have not engaged the services of a regulated financial adviser. Of those that have, many have only received transactional advice, i.e. advice on a particular issue such as life cover for a mortgage or pension advice.

Financial Planners, like us, can and do give regulated financial advice; however, besides, we provide much more in the way of personal context and a forward-looking financial plan.

What is Financial Planning?

I spend most of my day creating, reviewing and amending financial plans; it’s the crux of my role at Thornton.

But most people, namely those who don’t have one, are unaware of the peace of mind/clarity that can come from having a plan.

New clients tend to arrive at Thornton with very similar stories.

Why they have decided now is the time to focus on their finances and their specific situation will be different.

Still, typically they will have one or two pensions, some savings, maybe a rental property or an old investment – sold by the bank or a door to door salesman when that was acceptable practice!

They’ll own their own house, possibly with a mortgage. They might own a business. They may or may not have a good grasp of their expenditure and spending habits.

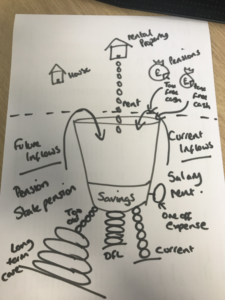

We turn this information into a picture – a picture of a bucket!

We turn this information into a picture – a picture of a bucket!

This picture of a bucket is a simple way of pulling together your liquid (in the bucket) and illiquid (outside of the bucket) assets.

We can look at your income and expenditure (taps), making informed assumptions (turn them up or down) based on your lifestyle, goals, hopes and aspirations.

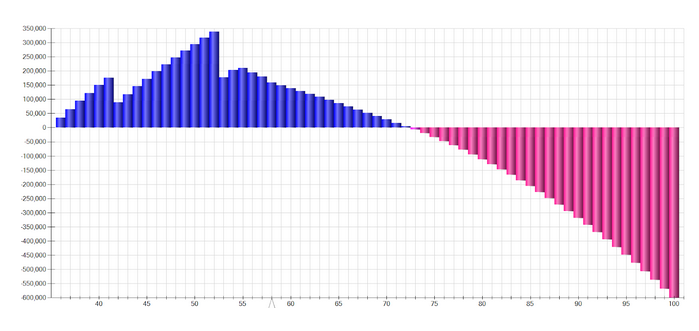

Does your bucket overflow or does it run dry? Is the hole in the bottom too big, or not big enough?

Put simply, a Thornton Financial Plan is turning this bucket into reality.

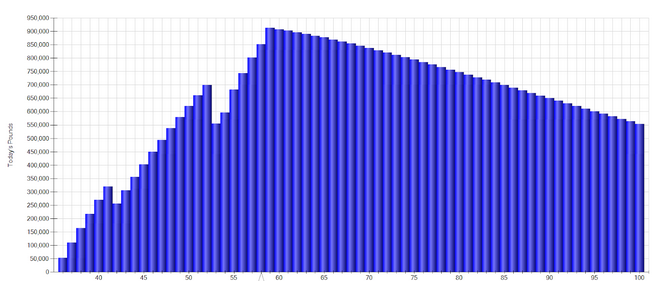

We can look to the future and see how your bucket is looking. Are you likely to reach the end of your life with an overflowing bucket

or is there a chance it will run empty along the way?

or is there a chance it will run empty along the way?

The critical point of the exercise is you know what the future might look like for you and if you don’t like it, you can change it! By identifying where you are headed, you can change course now.

Rewriting the future

True Financial Planning opens up the possibility to know and change the future.

There are only three ways to change your financial future:

1 – increase/decrease your income

2 – spend more/less

3- take more/less risk with your current financial assets

Having a Financial Plan provides the opportunity to discuss and factor in all of the above until you are left with a future of which you like the look.

Planning for the best-case scenario is all good and well, but one of the most beneficial outcomes of financial planning is preparing for the unknown and unexpected.

For our existing clients with these comprehensive plans, they have peace of mind, knowing that all imaginable scenarios have been considered.

By stress-testing plans using historic data and numerous predicted future outcomes, you have comfort in the knowledge that your plans remain on track, or if changes are needed, these will not be a surprise as contingencies have been put in place at the start.

By stress-testing plans using historic data and numerous predicted future outcomes, you have comfort in the knowledge that your plans remain on track, or if changes are needed, these will not be a surprise as contingencies have been put in place at the start.

Failing to plan is planning to fail, after all!

It’s not all doom and gloom though; planning is more often used to give you permission and confidence to live the life you want.

Getting the balance between today and tomorrow

Life is a tricky thing to plan for. Not knowing how long we’ll live for means we’re not sure if it’s a marathon or sprint that we’re running.

I, for one, don’t want to know either!

Balancing a quality lifestyle in the here and now, with a stress-free future is no simple task, but that is exactly why Thornton exists, and why I spend most of my days buried in Financial Plans.

In short, we:

-help you to become and remain financially well organised. We aim to demystify financial complexity to put you back in control.

-help you to better understand your relationship with money and give you more control to make positive “life” decisions around it.

-support you through tough financial decisions in your life as well as helping you to update your long-term plans in keeping with the uncertainties life undoubtedly brings.

-keep you on track. It’s easy to veer off course on any journey, but we will keep you focussed on what it is that you really want to achieve.

-give you the knowledge to understand your financial position, giving you the confidence to live the life you want to lead, free of fear and uncertainty.

-talk through your aspirations, giving honest feedback and challenging your plans and ideas objectively to ensure you are doing exactly what it is that you want to do.

Don’t delay

For those without a Financial Plan, there can be many unknowns and this has been highlighted by Covid-19.

People are starting to worry; questions are being asked

“What does the recent downturn mean to my plans?”, “Is my pension safe?”, “Is my pension enough?”, “What if my income reduces?” The list goes on.

What’s potentially worse is there are people blissfully unaware that they may not have enough in retirement and yet now is the time that something can be done about it.

Conversely, you may be in a position to work less, or not at all, but just not know it.

If you don’t have a Financial Plan, you are unlikely to be able to answer these questions.

Your financial future is a great unknown, and therefore, financial anxiety is a distinct possibility.

To arrange an initial complimentary call with one of our Chartered Financial Planners, do get in touch today.