How much will your Christmas dinner cost this year?

Unless you have somehow managed not to do a shop for 12 months, you know it’s more than last year!

Price inflation is rampant right now, driven higher by rising wholesale gas prices and the rising cost of food. We can all see this in our shopping trollies.

The cost of living in the IOM is up!

The most recent figures released by the IOM Government showed that inflation stood at 4.6% for November 2021, up from 4.4% in October 2021.

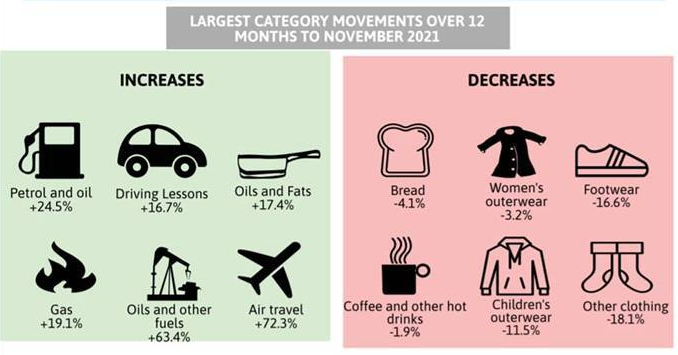

There were some significant increases over the 12-month period that caught the eye:

All items within the ‘Transport’ category experienced a significant increase in prices. ‘Air travel’ experienced the most considerable growth in prices (72.3%), followed by ‘petrol and oil’ (24.5%).

Within ‘Housing, water, electricity, gas and other fuels’, ‘oils and other fuels’ experienced the most significant increase in prices (63.4%).

Long term inflation drag

None of us knows what inflation will be in the years ahead but let’s assume it’s 3% per annum on average, and you’re getting 0.5% interest on your bank savings.

Losing the difference (2.5%) over one year is perhaps not too big a deal. But when compounded over 10, or 20 years, this small gap can develop into something of a chasm.

This loss of buying power can ultimately affect your ability to lead the lifestyle you want throughout your retirement and the legacy left to your family.

One of the main reasons people with capital or surplus income choose to invest is to retain (and ideally grow) the real value of their wealth over the long term.

Investing – the ups and the downs

Investing isn’t plain sailing; investments go up and down in value.

Some people cannot withstand the downs, financially or emotionally and are therefore unsuited. Keeping their money in cash/national savings is likely to be the best option for these savers.

This approach means taking the “inflation hit” on the chin over the years for the certainty of not seeing that money in the bank go down – at least on paper. There is nothing wrong with this.

For others, there’s a balance to be achieved in holding the right amount of cash (you need to have some) and investments.

Historically, investors in what we would call sensible, well-diversified investment portfolios, who invest in a wide range of the world’s great companies, have beaten cash deposits comfortably.

Getting the balance right

As Chartered Financial Planners, we help achieve this balance for you.

Investing is a bit like life; when it’s “up”, all is rosy in the garden, and when things take a turn the other way, not so much so.

Sometimes we need support and counsel from people to get us through those periods.

One such period was March 2020, when the economic impact of Covid-19 emerged, and almost all investments fell sharply temporarily.

This period was a difficult time for many investors.

We reminded our clients to keep focused on the long term “prize”, avoiding making snap decisions and helping to ensure that they could maintain the lifestyle they desired all year round in the decades ahead.

Back to Christmas dinner

Think about how much a Christmas dinner might cost in 10- or 20-years’ time.

This thought will focus the mind on why you invest already (through the ups and downs), or if you don’t, why perhaps you should consider investing some of your cash for the long term.

Have a great festive period, and enjoy your Christmas dinner!