I am a renter and also an aspiring homeowner. My husband and I have packed up and moved countries several times.

Financially, we would have been better off staying put and getting a mortgage.

However, you cannot, and nor should you, quantify the benefits and costs of every life adventure (and we have had many!). How dull would life be if we lived it through a spreadsheet?

This article is aimed at the next generation of aspiring homeowners (and renters) facing all-time high home prices and high borrowing costs.

Expensive housing markets affect jurisdictions worldwide, including the Isle of Man and the United Kingdom. Life might generally be more convenient today than for past generations, but the decreasing affordability of housing relative to wages is very concerning.

More and more people are being priced out of the housing market. Renting is a necessity rather than a choice for many.

Wages versus house prices in England

Consider that in 1999, the median house in England cost 4.4 times the median full-time salary (according to the UK Office of National Statistics).

Fast forward to 2022, and an average full-time employee can expect to spend around 8.3 times their full-time salary buying a home. That means today’s buyer, on average, has to save twice as much for a house deposit and pay twice as much for the same house as their parents did (or someone 20 years ago).

Granted, the current interest rate of 5.25% may appear low for those who have lived and borrowed from the 1980s through to the 1990s when the average interest rate was 12% and at its height reached 17%.

However, the median home price in the UK was circa £25,000 in 1980 and reached a value of circa £60,000 in 1990.

Interest rates were higher in the 80s and 90s, but the amounts borrowed were significantly lower. The size of the mortgage in the 80s to 90s is the size of today’s 10% deposit!

Today’s buyers have a much steeper road to climb to homeownership. Unsurprisingly, parents and grandparents are helping more and more with house deposits. It is no longer the exception; it is the norm.

The Isle of Man numbers

The numbers for the Isle of Man look even worse.

The median home price in the Isle of Man was £386,955 in December 2022 (according to the Isle of Man in Numbers 2022 report).

The Isle of Man median full-time gross salary was £34,996. That means the typical earner can expect to spend 11 times their earnings on a house.

Based on the wages-to-home price metric, housing on the Island is more affordable than in London (one of the priciest housing markets in the world). However, compared to other English regions, saving for a house on the Island would take up to twice as long.

Looking further afield, housing affordability in Scotland and Wales is on par with affordability in England’s cheapest regions.

The statistics geeks will note that I have used median rather than average wages. That is because the average wage is not representative of the average person (if such a person even exists).

The average is skewed upwards by high earners. Imagine Elon Musk or Bill Gates walking into a pub, instantly causing all the patrons, on average, to be millionaires!

The Island’s high property prices relative to the UK can be defended.

The average earner in the Isle of Man pays circa £1,035 less in income taxes annually compared to someone in the UK.

The Island is beautiful and one of the world’s safest places to raise children. However, living on an island can be more expensive or less convenient (e.g. imported goods, off-island travel). The option to simply move to a cheaper housing region is also limited (because you will soon reach the sea!).

Cost of borrowing for a home

Today, someone borrowing to buy a home in the Isle of Man and the United Kingdom pays 5% to 8.5% p.a. in interest. The lower percentage is for 5-year fixed-term mortgages, and the higher percentage is for variable-rate mortgages.

Your personal borrowing rate will depend on the deposit size relative to the home price and your finances. The lower the risk you are to the bank, the lower the interest rate you will pay.

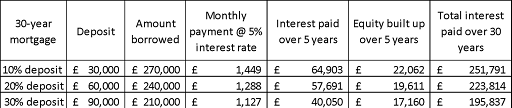

I’ve calculated the cost of buying a property valued at £300,000. This is lower than the average home price in the Isle of Man (£386,000 as at December 2022).

The figures show how the monthly payments vary depending on the size of the deposit. I’ve used a 5% borrowing rate for illustration.

The Bank of England recently reiterated that rates will stay higher for longer, and we probably won’t see large reductions until the end of 2024.

The banks may use a higher interest rate to stress test your ability to repay the mortgage.

You can tailor the figures to your circumstances with this online calculator: https://www.calculator.net/amortization-calculator.htm

The above figures show how expensive it is to borrow, even if you can afford a 10% to 30% deposit.

Monthly mortgage payments are not your only cost when you become a homeowner. You must add property taxes (council rates), insurance, maintenance costs, etc.

The above table also shows that for the first five years of mortgage payments, the interest alone (£40K to 65K over 60 months) is comparable to the total monthly rent for an apartment or home over the same period.

You would also avoid property taxes, insurance, and maintenance costs as a renter.

Which is better: renting or buying?

For most people, buying a home is the right financial decision at some point. Renting is cheaper in the short term but more expensive in the long run.

In the short term, renting is cheaper because renters don’t need to save for a large deposit or cover the costs that a landlord would. Your monthly expenses are more predictable.

During the last year, our washing machine and boiler needed substantial repairs. The landlord paid all costs for both items.

In the long run, renting is more expensive because lifelong renters need to save more for retirement than homeowners. The mortgage payments eventually end, but the rent never stops.

However, it is possible to rent long-term and be financially no worse off than a homeowner. It requires careful planning and savings discipline and investing any cost savings achieved by renting.

Owning a property is similar to holding company shares. In the short term, the value can go up or down. In the long-term, the value tends to go up.

The longer your ownership period, the greater the likelihood of an increase in value. It makes financial sense to have at least a 5-year time horizon for buying a home and investing.

Renting versus buying is an emotional decision, not just a financial one. Owning provides stability and predictability, which become more important when you have children.

Your home is yours. You don’t have to worry about rent increases or being booted out of the house. Ultimately, that is why, for me, buying is the right decision.

Control the controllable: what does that mean?

Traditional financial planning wisdom says to control the controllable. In other words, the advice is to earn more, spend less and save/invest more to reach your financial goals faster.

We are all in the stormy seas of higher house prices, but we are not in the same boat. Some people have different abilities to increase their earnings. Only some people can cut costs and save more. Only some people can get a helping hand from family members.

Whatever your circumstances, get in touch with a mortgage broker to determine what you can afford and how to increase your ability to qualify for a mortgage.

Can you target a more affordable housing option if your earnings and expenditures are relatively fixed? For example, how many bedrooms are needed? Could a semi-detached home or apartment work?

What about a cheaper but likely less convenient location? What is negotiable, and what is non-negotiable for you?

Once you have a rough idea of your budget, contact an estate agent and see as many properties as possible in your price range.

Buying a home will be one of the biggest purchases of your life, and planning is required. Don’t assume that it is too early (or too late).

After running the numbers, you might determine that a property purchase isn’t likely in the next 5 to 10 years. In that case, use the time wisely.

Save and invest small amounts every month. Your future self will thank you for preparing and bringing your housing goals within reach.